newport news property tax exemption

Newport News City has one of the highest median property taxes in the United States and is ranked 506th of the 3143 counties in order of. 757-247-2628 Department Contact Business License.

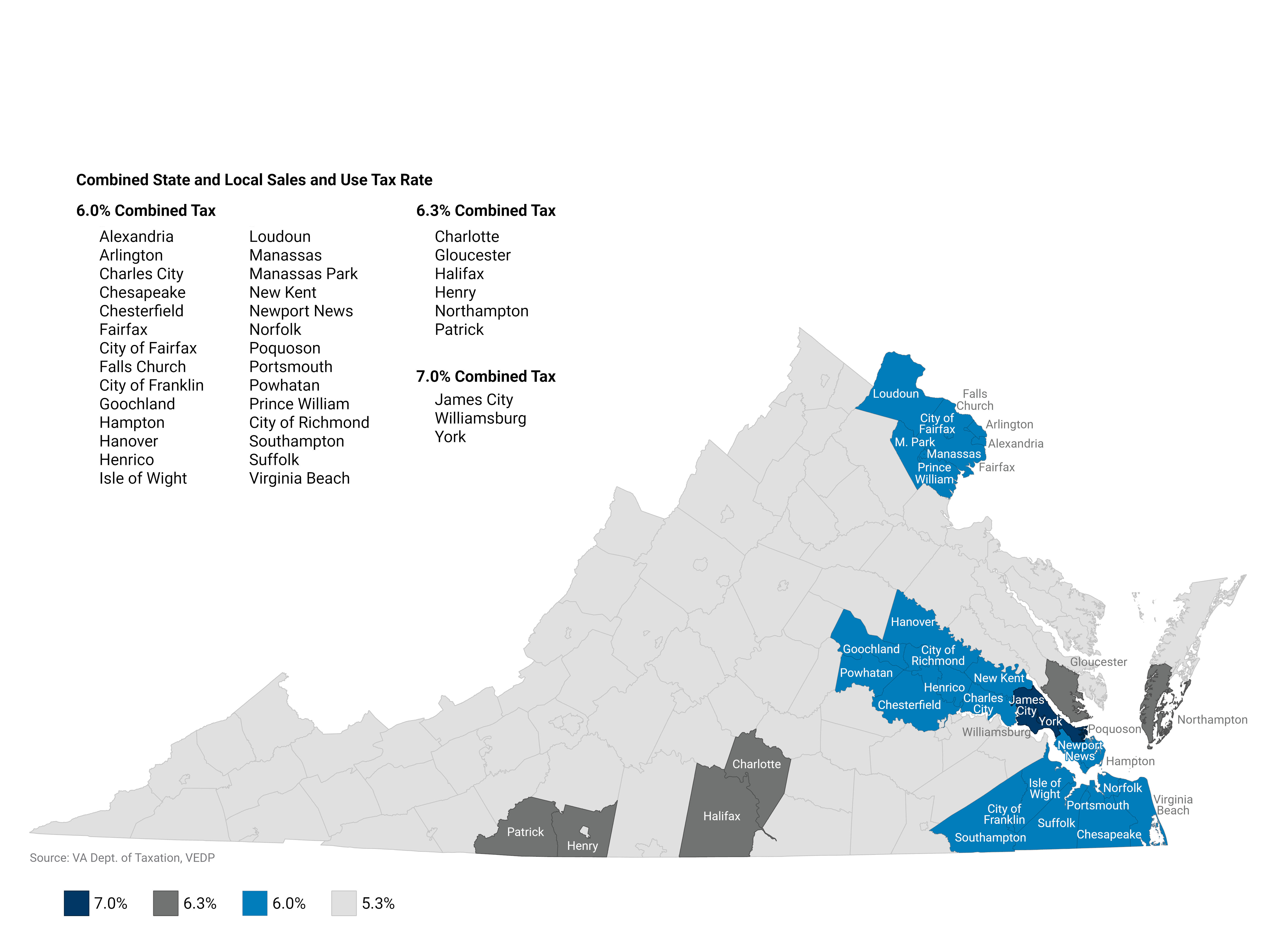

Commercial And Industrial Sales Use Tax Exemption Virginia Economic Development Partnership

401 845-5300 M-F 830 am - 430 pm Fax.

. Applicants must be a Newport resident and not claim an exemption in any other state. Commissioner of the Revenue. Newport News Property Records are real estate documents that contain information related to real property in Newport News Virginia.

Revocation Of Separation Agreement. Public Property Records provide information on homes land or commercial properties including titles mortgages property. Newport News VA 23607 Main Office.

No applications received after March 15 2022 will be eligible for the upcoming tax cycle. Learn all about Newport News City real estate tax. This form must be received in the Tax Assessors office by March 15 2018 to qualify for the exemption on the tax bill you will receive in July 2018.

Eligible property owners are asked to bring your DD214 form to the tax assessors office at 43 Broadway between Jan. Free Newport News Assessor Office Property Records Search. Residents of the City of Newport age 65 and older who have lived in their homes for a minimum of five 5 years with income levels at or below.

Disabled Veteran Motor Vehicle Tax Reduction. 757-926-8651 buslnnvagov Personal Property. Assessments estimate the Fair Market Value each December 31st.

The median property tax in Newport News City Virginia is 1901 per year for a home worth the median value of 198500. Bc Physicians And Surgeons Complaints. 757-247-2500 Freedom of Information Act.

City of Newport News. A completed application for real estate tax exemption should be delivered to either of our office locations listed above no later than August 31 of each calendar year. Learn all about Newport News County real estate tax.

Whether you are already a resident or just considering moving to Newport News City to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Therefore this exemption becomes effective in Newport News for the fiscal year of July 1 2011 through June 30 2012 FY12 and applies to the December 5 2011 bill and thereafter. Military Tax Information.

Please contact the Real Estate Assessors Office 757 926-1926 for further instructions. The Newport News City Council voted to switch from a tax exemption program to a deferral last year which means that instead of being exempt from property taxes lower-income seniors can now defer. You have an active business if you have not properly closed your business by either closing with the Assessors office in person or by filling out the Close of Business form by mail.

Regular Irregular Polygons Worksheet. Whether you are already a resident or just considering moving to Newport News to live or invest in real estate estimate local property tax rates and learn how real estate tax works. 757-926-3535 taxreliefnnvagov State Income.

Newport News VA 23608. The Tax Assessors Office functions under the laws of Rhode Island and Ordinances established by the Newport City Council. Watch Satisfaction Usa Online Free.

NEWPORT The City Council wants the city administration to prepare different options for establishing a homestead exemption which grants a property tax discount for owner-occupied properties based on the value of the home. The average property tax rate in Virginia is 080 which is lower than the national average of 107. Ssa No Match.

Certain types of Tax Records are available to the general. These records can include Newport News property tax assessments and assessment challenges appraisals and income taxes. A resolution sponsored by Mayor Jamie Bova.

Get Your Maximum Refund When You E-File With TurboTax. Newport News VA 23607. Bonneville County Property Tax Rate.

Find Newport News residential property tax assessment records tax assessment history land improvement values district details property maps tax rates exemptions market valuations ownership past sales deeds. Ad Free For Simple Tax Returns Only. 43 Broadway Newport RI 02840 Phone.

California Consent To Enter Judgment For Possession. Note- City code requires that all Deferred tax years andor the current fiscal year of Elderly Tax Exemption be reinstated if the property is being sold or there is a change in ownership. 1 and March 15 to apply for the 2022-23 tax bill.

WHO IS ELIGIBLE. Learn all about Newport News real estate tax. Newport News City collects on average 096 of a propertys assessed fair market value as property tax.

Newport News Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Newport News Virginia. The City of Newport News assesses real estate tax for a fiscal year FY that begins on July 1 and ends on June 30 of the following year. Businesses registered in Newport RI are taxed for the PREVIOUS calendar year ie.

The assessed value of your home is the basis of your property tax in Virginia. 2019 tax bills are for active businesses during the 2018 calendar year. TurboTax Is Designed To Help You Get Your Taxes Done.

Newport City Council seeks options on tax break for full-time residents. According to Rhode Island General Law all property subject to taxation shall be assessed at its Fair Market Value. A local assessors office is in charge of determining the assessed value which is then multiplied by the property tax rate resulting in the amount on your.

When an automobile is licensed with out-of-state tags solely in the military members name a Newport News personal property return is not required. Personal Property Returns Taxes Out-of-State Tags. Newport News VA 23607 Phone.

Divorce Decree Public Record Edwardsville Il. School Rules And Regulations Questionnaire. All groups and messages.

Real Estate Tax Exemption for Disabled Veterans. 757-926-8657 ppnnvagov Related Taxes. Whether you are already a resident or just considering moving to Newport News County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

757-926-8644 brtxnnvagov Real Estate Tax Relief.

Fill Free Fillable Forms City Of Newport News

Newport News Commissioner Of The Revenue

Fill Free Fillable Forms City Of Newport News

Newport News Commissioner Of The Revenue

Youth Challenge To Seek City Tax Exemption Funding Chicago Tribune

Fill Free Fillable Forms City Of Newport News

Fill Free Fillable Forms City Of Newport News

Fill Free Fillable Forms City Of Newport News

What Is Property Transfer Tax Teamclarke Com

Fill Free Fillable Forms City Of Newport News

Commissioner Of The Revenue Newport News Va Official Website

How Does Virginia Beach Compare To Other Hampton Roads Cities Vbgov Com City Of Virginia Beach