hawaii capital gains tax calculator

Since 2018 the rate is 75 up from 5. Long Term Capital Gains Tax Brackets for 2021 It should also be noted that taxpayers whose adjusted gross income is in excess of 200000 single filers or heads of household or 250000 joint filers may be subject to an additional 38 tax as a net investment income tax.

Hawaii Income Tax Calculator Smartasset

The tax rate you pay on your capital gains depends in part on how long you hold the asset before selling.

. Long Term Capital Gains Rate 2022 Hawaii Capital Gains Tax Rate 2022 It is commonly accepted that capital gains are the result of earnings generated by the sale of assets such as stocks real estate or a company and are tax-deductible income. A 25 commission not 7 must be paid on the sale price. Those who earn 60000 or more are subject to a 7 capital gains tax rate in Hawaii.

The current top capital gains tax rate is 725 which critics point out is a lower tax rate than many Hawaii residents pay on their wages and salaries. Taxpayers with adjusted gross incomes above 250000 filing jointly or 200000 filing individually may be subject to an additional 38 Medicare tax on investment income. In calculating the amount you have to pay to tax on the gains a lot relies on how long you had the item before.

Under Hawaii State law seven percent is withheld. A 20 percent tax rate is. The Hawaii State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Hawaii State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

Howard Hopkins April 25 2021. Like the Federal Income Tax Hawaiis income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. Capital gains tax rates on most assets held for less than a year correspond to.

You will receive 25 of the sales price. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. In Hawaii capital gains on real estate are subject to a 75 tax.

Use our capital gains calculator to determine how much tax you might pay on sold assets. The Hawaii Department of Revenue is responsible for publishing the latest Hawaii State. The capital gains rate will be 15 percent on income between 40401 and 445850 however.

Since 2018 the rate is 75 up from 5. 2020 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status. Hawaii Capital Gains Tax Calculator.

The state of Hawaii has the lowest property tax rate in the nation at 028. Hawaiis maximum marginal income tax rate is the 1st highest in the United States ranking directly. The calculator on this page is designed to help you estimate your projected long-term capital gains tax obligation based on the income made from your assets as well as the nuances of your financial circumstances.

If the collected amount is too large how do you obtain a refund. If you are in the 396 bracket your long-term capital gains tax rate is 20. Hmrc Capital Gains Tax Calculator.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Further State Capital Gains Tax Information for Hawaii While the federal government taxes capital gains at a lower rate than regular personal income states generally apply the same rate for capital gains as regular income. As an example if an individuals taxable income falls below 40400 for the year 2021 the individual wont have to pay capital gains tax.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year. The IRS taxes capital gains at the federal level and some states also tax capital gains at the state level. A 25 commission not 7 must be paid on the sale price.

This is because Hawaii has the highest median home value in the US. You will receive 25 of the sales price. The realized gains amounted to 25.

House members take their oaths of office on. AKA HARPTA Hawaii Real Property Tax Act is a state taxation law for property. Also keep in mind that the long-term capital gains rate for.

Hawaii collects a state income tax at a maximum marginal tax rate of spread across tax brackets. The realized gains amounted to 25. Hmrc Capital Gains Tax Calculator Non Resident.

Despite this the median annual tax payment in the state is 1871 which is much higher. You will pay either 0 15 or 20 in tax on long-term capital gains which are gains that are realized from the sale of investment you held for at least one year. If the 725 of sales price withholding is too large the owner files a Hawaii form N-288C after closing.

Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. There are short-term capital gains and. Form N-15 for the year is available then the owner should file the.

In this case short- and long-term capital gains are regarded as one form of gain. Does State Of Hawaii Have Capital Gains Tax. Hawaii Capital Gains Tax In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status.

The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. You are able to use our Hawaii State Tax Calculator to calculate your total tax costs in the tax year 202122.

Calculations are estimates based on the tax law as of September 2021. If the appropriate Hawaii income tax return ex. Our calculator has been specially developed in order to provide the users of the calculator with not only how.

If you are in the 25 28 33 or 35 bracket your long-term capital gains rate is 15. AKA HARPTA Hawaii Real Property Tax Act is a state taxation law for property. 28 Capital Gains Tax Rate Worksheet.

21 Gallery Of Hawaii Capital Gains Tax Calculator. Hawaii Capital Gains Tax Worksheet. Under Hawaii State law seven percent is withheld.

The Hawaii capital gains tax on real estate is 725. Hawaii Capital Gains Tax Table. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds.

How To Calculate Capital Gains Tax H R Block

Cryptocurrency Taxes What To Know For 2021 Money

Real Estate Capital Gains Calculator Internal Revenue Code Simplified

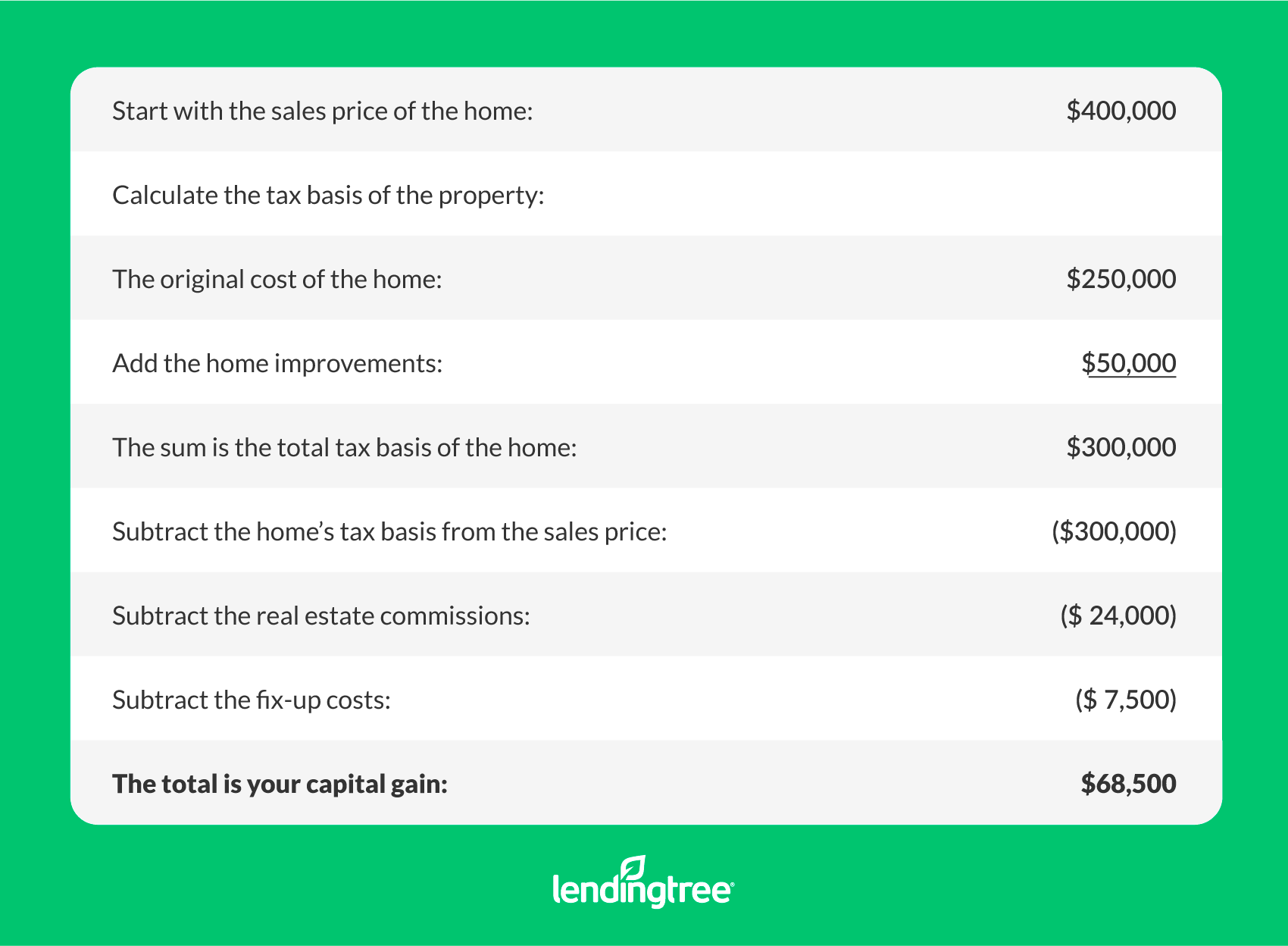

Capital Gains Tax On A Home Sale Lendingtree

Llc Tax Calculator Definitive Small Business Tax Estimator

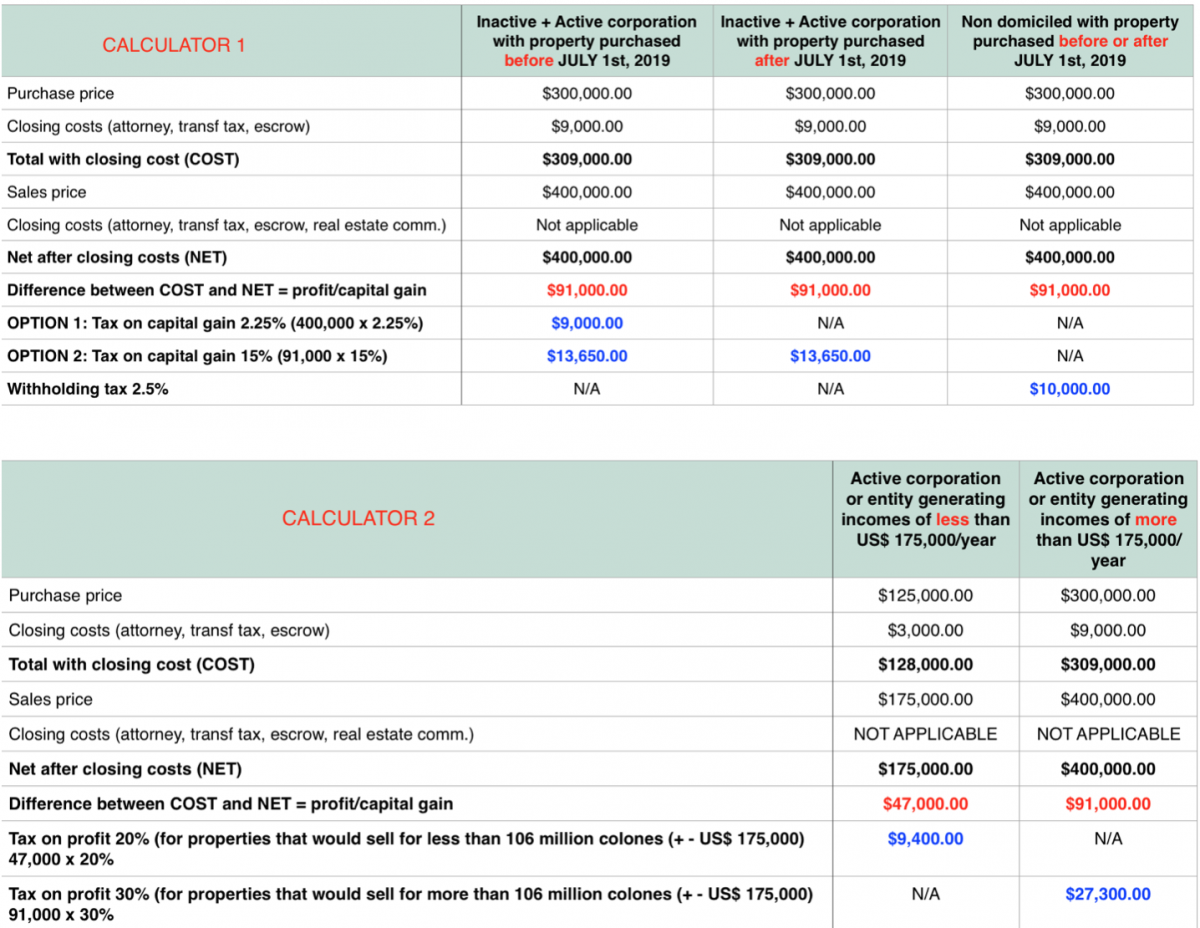

Capital Gain Tax In Costa Rica Remax Ocean Surf Sun

Quarterly Tax Calculator Calculate Estimated Taxes

Transfer Tax Calculator 2022 For All 50 States

Hawaii Income Tax Hi State Tax Calculator Community Tax

New Capital Gains Tax By Property Type

2021 Capital Gains Tax Rates By State Smartasset

2021 Capital Gains Tax Rates By State Smartasset

P2p Financing Travel Insurance Medical Insurance Investing

Cyprus Capital Gains Tax For The Disposal Of Immovable Property In Cyprus

Hawaii Income Tax Hi State Tax Calculator Community Tax

Capital Gains Tax Calculator 2022 Casaplorer

Introducing The Biggerpockets Brrrr Calculator Finance Blog Real Estate Investing Rental Property Rental Property Management

8 Different Types Of Income Streams Income Streams Dividend Income Income